Hey Thrivers!

Here, we mostly talk about how to make money online, start digital side hustles, or grow your blog. But let’s be real, saving that money is just as important.

You can make $10K a month, but if it’s all gone by the 30th, you’re just busy, not wealthy.

So today, let’s talk about a simple money management rule that can actually help you keep your money, grow it, and still live a chill, comfortable life – the 70-20-10 budget rule.

I’ve personally tried a bunch of budgeting styles over the years, and this one is ridiculously simple, even if you hate spreadsheets (like I do).

Let’s break it down.

So… What Even Is the 70-20-10 Budget Rule?

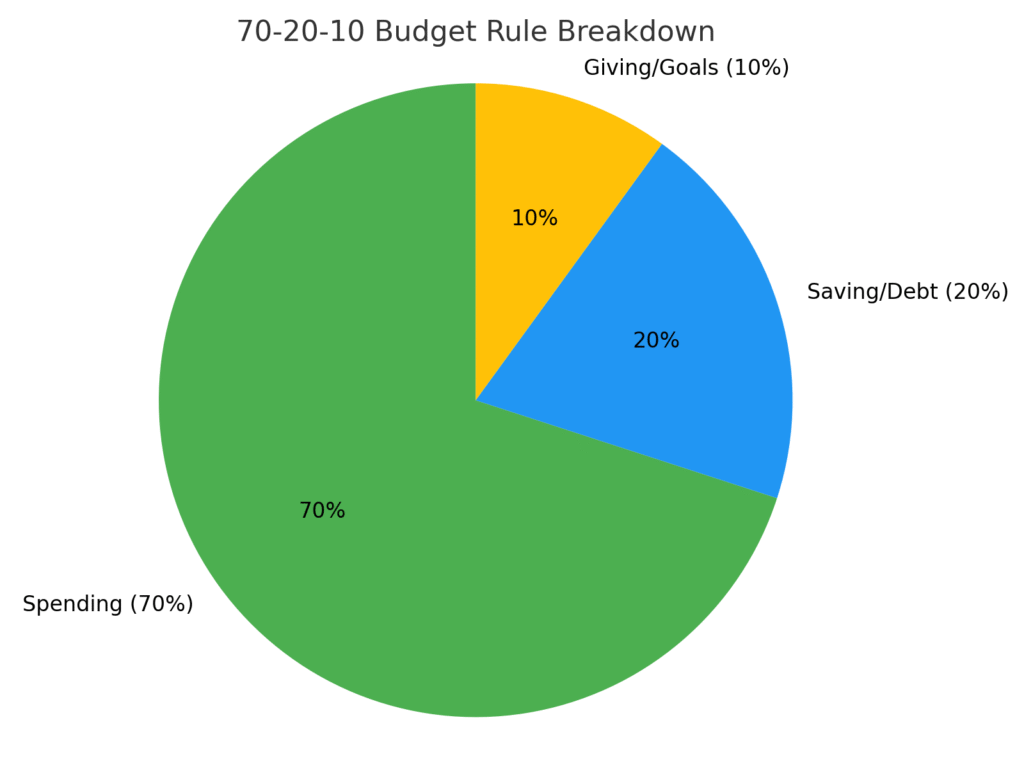

It’s a no-fuss, 3-part budgeting method where you divide your monthly after-tax income like this:

- 70% goes to spending (bills, rent, groceries, and lifestyle stuff)

- 20% goes to savings or paying off debt

- 10% goes to giving, donations, or personal growth

That’s it. No 10-line Excel formulas. No headache. Just a simple split.

It gives your money a job and helps you avoid those “Where did my paycheck go?” moments.

Real-Life Example: You Earn $4,000 a Month

Let’s say you bring in $4,000/month after taxes (either from a job, freelancing, or your blog). Here’s how it breaks down:

| Category | Percentage | Dollar Amount | Covers… |

|---|---|---|---|

| Spending | 70% | $2,800 | Rent, food, gas, utilities, groceries, phone bill, Netflix, takeout, gym, shopping, etc. |

| Savings or Debt | 20% | $800 | Emergency fund, high-yield savings, IRA, paying off credit card, investing in ETFs, etc. |

| Giving/Growth | 10% | $400 | Donations, helping family, online courses, starting a side hustle, therapy, travel fund, etc. |

Pretty clear, right?

SEE ALSO: Frugal Living Tips for Beginners : Real-Life Tips That Actually Work

Why I Love This Budgeting Rule (And You Might Too)

It’s simple as hell, even if you hate numbers. The best part? You get to spend guilt-free because you’ve already handled your savings.

You’re not forced into that boring “save everything and live like a monk” routine, either.

With this approach, you can actually enjoy life while still building wealth in the background. And honestly, when I started following something like this, it genuinely felt like I got a raise not because I earned more, but because I kept more.

What If You Don’t Want to “Give” 10%?

Totally valid. That 10% isn’t only for charity. You can tweak it depending on your values:

-

Want to donate to a cause you believe in? Go for it.

-

Want to use that 10% to buy a new mic for your YouTube channel or take a $99 Pinterest course? That counts.

-

Want to put it into your travel fund? Still good.

Point is: this 10% is about purpose, not impulse. Use it intentionally.

Can You Customize It?

Yes. This rule is flexible.

If you live in NYC or LA, 70% might barely cover your rent and groceries. So tweak it.

Here are a few alternatives:

- 80-15-5 if your living expenses are high

- 60-30-10 if you want to save more aggressively

- Or even 50-30-20 (another popular one)

Use the rule as a base, not a prison.

Quick Reference Table

Here’s how it would look with different monthly incomes:

| Income | 70% Spending | 20% Saving/Debt | 10% Giving/Growth |

|---|---|---|---|

| $3,000 | $2,100 | $600 | $300 |

| $4,000 | $2,800 | $800 | $400 |

| $5,000 | $3,500 | $1,000 | $500 |

| $6,000 | $4,200 | $1,200 | $600 |

You can screenshot this and refer to it while setting up your monthly budget.

Pro Tips:

Automate savings: Have 20% auto-transferred to savings right after payday. Out of sight, out of spending range.

Use multiple accounts: One for bills, one for savings, and one for spending. Helps separate priorities.

Adjust seasonally: Some months, your expenses might spike. No guilt, just rebalance the next month.

Track the first 2 months: It helps to see if your real-life spending aligns with your plan.

SEE ALSO:

Final Thoughts

So, that for now folks.

The 70-20-10 rule is perfect for people who want clarity without complexity.

If you’re not ready for hardcore budgeting apps or spreadsheets, this is a great way to start taking control of your finances and actually feel good about it.

And hey, even if you can’t stick to it 100%, following it even 70% of the time is way better than having no plan at all.

Try it for the next paycheck and let me know how it goes. You’ll be surprised how freeing it feels to know where your money is going.

Note: Some of the links on this page are affiliate links, which means we may earn a small commission if you choose to make a purchase through them-at no extra cost to you. We only recommend products and services we genuinely believe in and find useful.